Choosing the right health insurance plan isn’t just about finding a good price—it’s about matching your coverage needs, preferred providers, and long-term health goals. Below we unpack five top insurance carriers in the U.S., detailing what they offer, where they shine, and their potential drawbacks.

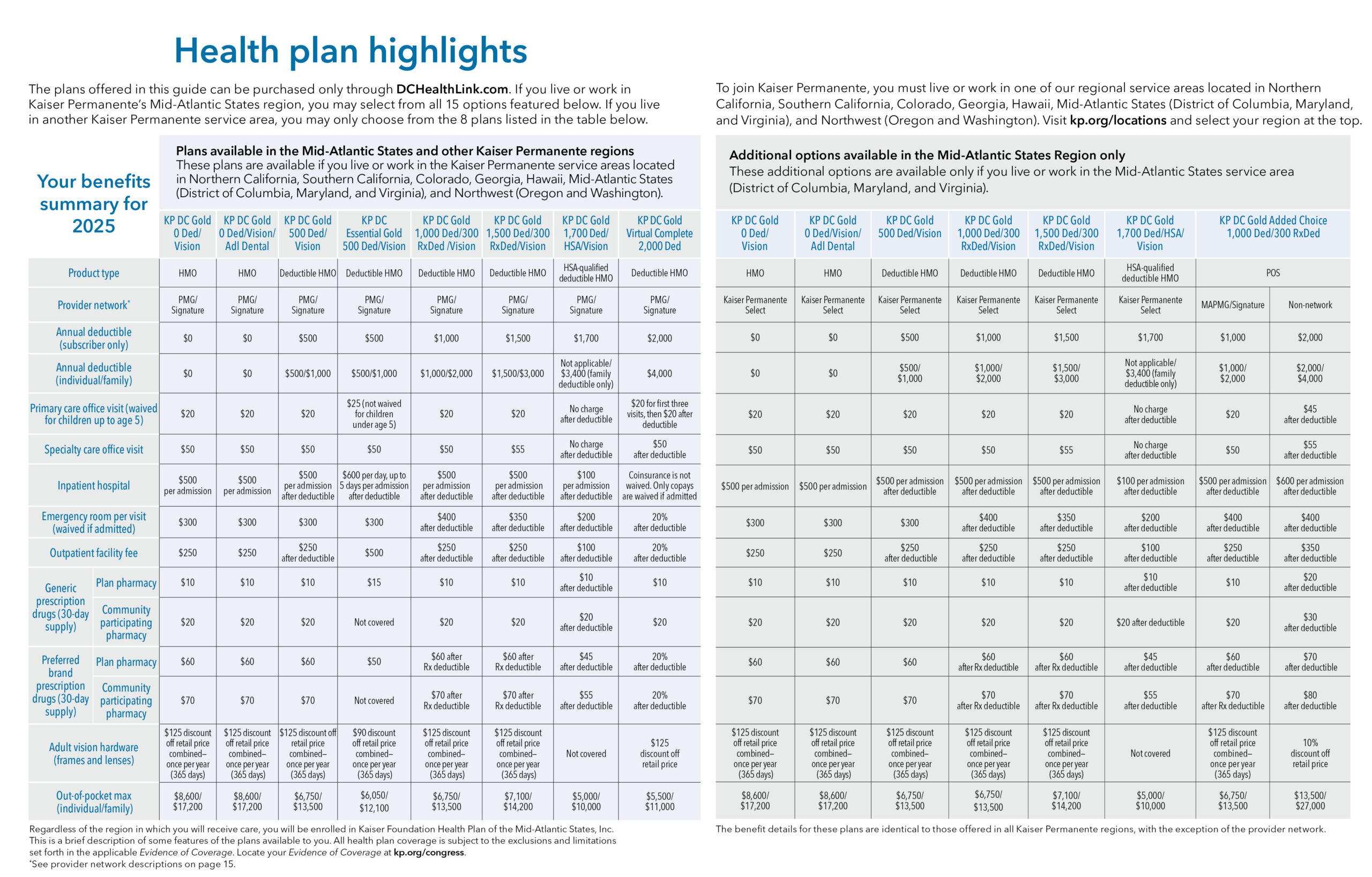

1. Kaiser Permanente

6

What makes it stand out:

- Kaiser operates an integrated care model: providers (physicians, hospitals, labs) largely within its own system. This can mean smoother coordination of care and fewer hand-offs.

- Ratings and reviews consistently place Kaiser high for customer satisfaction, coordination of care, and member experience. Insure.com+2Forbes+2

- Strong emphasis on preventive and wellness services, which can help minimize cost and care surprises.

Key benefits (typical plan features):

- Many plans include $0 or low-cost primary care visits (depending on state/plan).

- In-network specialists, hospitals, and labs all managed under one system — often reducing administrative burden.

- Digital tools, telehealth/in-home services, and preventive-care infrastructure embedded in the model.

- Especially good in states where Kaiser has major presence (e.g., California, Colorado, Washington, Georgia) then you benefit from full network.

Potential drawbacks:

- Geographic limitation: Kaiser’s coverage is limited to certain states and regions. If you move or travel often, access might be more restricted.

- Network inflexibility: Because the model is mostly in-system, going out-of-network can be costly or not permitted except in emergencies. If you already prefer providers outside Kaiser’s network, this may be a barrier.

- Referral/coordination model: Although streamlined, some members dislike having to go through primary care or network specialists rather than accessing any doctor freely (compared to a broad PPO).

Best for: Consumers who live in a Kaiser service area, want an integrated “one-system” experience, and prefer coordinated care rather than maximum provider choice.

2. Blue Cross Blue Shield Association (and its statewide/licensed carriers)

6

What makes it stand out:

- BCBS (and its 35+ licensees/affiliates) covers virtually every state, giving a very broad geographic footprint. Wikipedia+2venteur.com+2

- Because of that broad network, you often get access to many hospitals and specialists, which is favorable if you travel, move, or value provider choice.

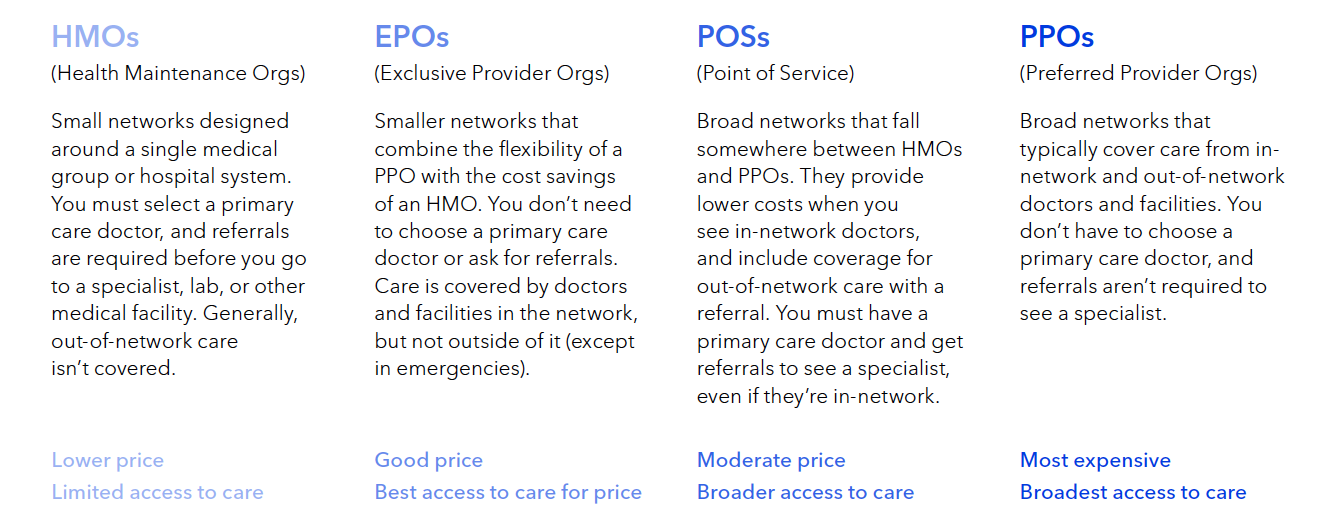

- A wide variety of plan types (HMO, PPO, EPO) depending on state affiliate — meaning flexibility in plan structure.

Key benefits (typical plan features):

- Large in-network provider database; you’ll often find your local hospitals and doctors already affiliated with your local BCBS carrier.

- Strong brand and local market presence—many employers trust BCBS, which may mean good plan availability for individuals/families through marketplaces or off-exchange.

- Potential access across states via the BlueCard network (useful if you travel or spend time in different regions). Wikipedia

Potential drawbacks:

- Because of the broad network and flexibility, premiums or out-of-pocket costs may be higher compared to restricted-network plans or those with fewer provider options.

- Plan quality and customer experience vary significantly by state affiliate. Just because BCBS is “strong overall” doesn’t guarantee excellent service in your specific state.

- More provider choice can sometimes result in less integrated care coordination.

Best for: People who want maximum access to doctors/hospitals, live in a state with a strong BCBS affiliate, and are comfortable potentially paying a bit more for that flexibility.

3. UnitedHealthcare

6

What makes it stand out:

- UnitedHealthcare is one of the largest carriers in the U.S., with huge resources, extensive networks and strong tech/wellness offerings. peoplekeep.com+2Healthline+2

- The insurer has heavily invested in digital health tools (virtual visits, app-based services, wellness/rewards programs) which appeal if you value tech/innovation.

- Because of its size and presence, you may find many plan options and availability across states.

Key benefits (typical plan features):

- Virtual care/telemedicine included or discounted in many plans — great for convenience.

- Wellness / incentive programs (e.g., tracking activity, health challenges) which might reduce costs or provide perks.

- Large network and coverage options, including individual/family marketplaces, employer plans, Medicare Advantage (depending).

- Strong financial standing and brand stability.

Potential drawbacks:

- Despite size, not all providers/hospitals may be in-network — you’ll need to check for your specific area.

- Large insurers can have more complex plan structures, more variations in coverage, more fine print. Might require more review.

- Some reports of customer-service or claims‐denial issues (as with many large carriers); quality can vary by region. (Large size ≠ perfect service everywhere.)

- Because of wide reach and features, premiums/out-of-pocket costs might be higher in some plan tiers compared to more regional or leaner plans.

Best for: Those who value digital health tools, broad coverage options, are comfortable with examining plan details and provider networks, and want a large national carrier backing.

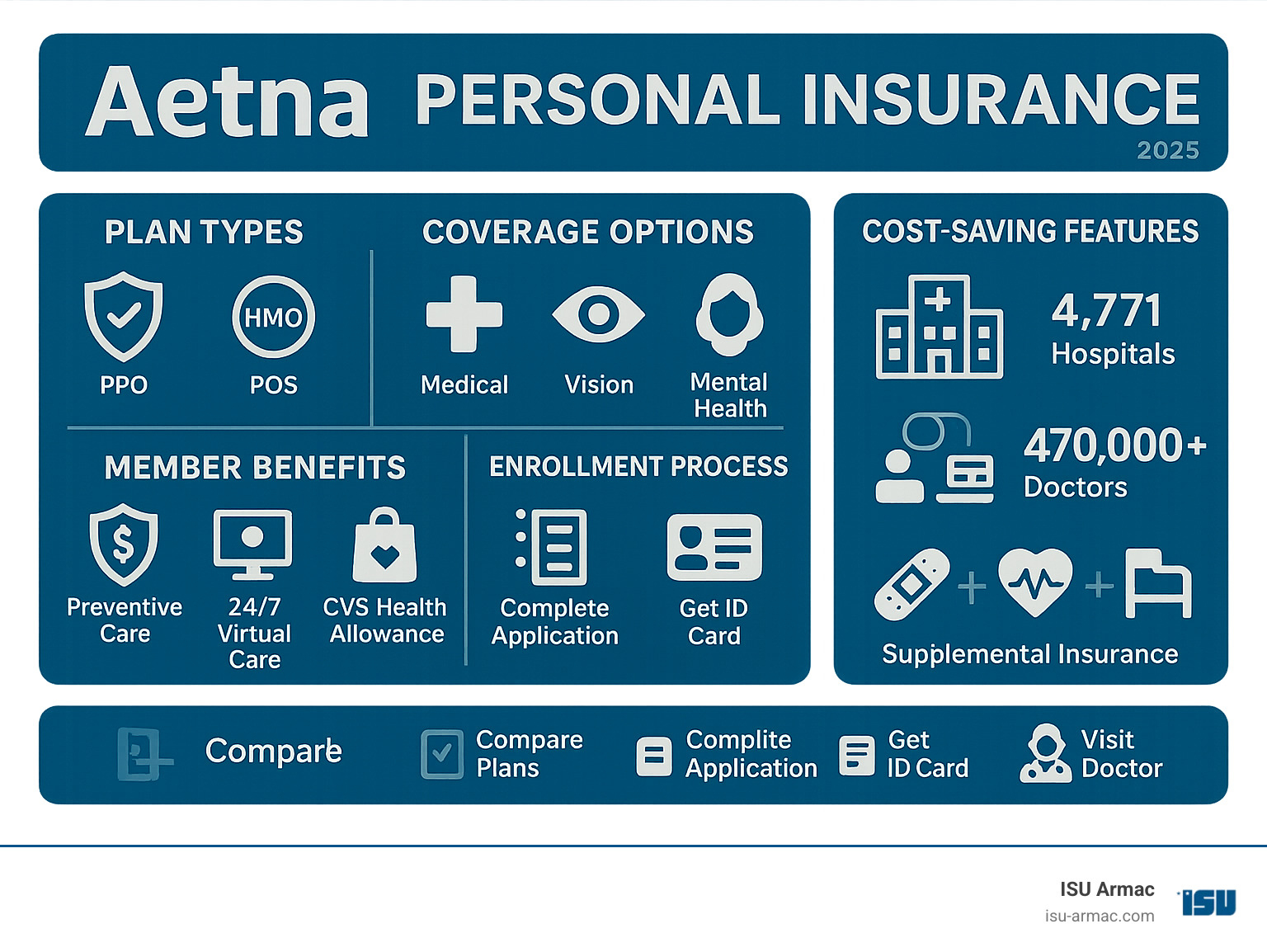

4. Aetna (CVS Health)

6

What makes it stand out:

- Aetna, now part of CVS Health, blends insurance with pharmacy benefit management and retail health components — meaning potential value in drug/retail integrations.

- It is often rated well in affordability and selection. ValuePenguin+1

- Some plans include value-adds like adult dental/vision, fitness/wellness discounts, generic-drug copays that may be competitive.

Key benefits (typical plan features):

- Some individual/family plans include $0 visits to primary care (in certain states/plans), or very low copays for generics.

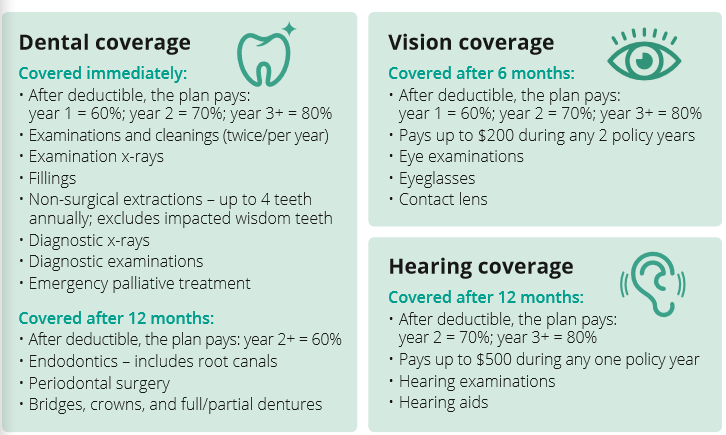

- Optional adult dental and vision coverage in some states (via Aetna) bundled or add-ons — adds value.

- Strong pharmacy-benefit management due to CVS link; convenience in combining medication, health plan, retail health visits.

- Good choice of plan types and marketplace presence in many states.

Potential drawbacks:

- Availability of specific plan features (e.g., $0 PCP visits, adult dental/vision add-ons) is highly state- and plan-dependent — you’ll need to verify your local market.

- Aetna has signaled exiting some ACA-marketplace states or reducing offerings in future years, which may impact continuity or choice. (See news of Aetna exiting some markets.)

- As with large carriers, network provider coverage and service satisfaction can vary by region.

Best for: People who want value-added extras (dental/vision, pharmacy integration), live in states where Aetna is strong, and are comfortable confirming plan-by-state specifics.

5. Oscar Health

6

What makes it stand out:

- Oscar is a newer, more tech-savvy insurer focused on individual/family marketplace segments, with streamlined apps, virtual care, member experience emphasis.

- It’s often recognized for user-friendly digital interfaces and incentives for health engagement.

- Because it is smaller than the huge legacy carriers, it may offer competitive premiums in certain markets for consumers willing to trade some provider-network breadth for simplicity and innovation.

Key benefits (typical plan features):

- Many plans emphasize virtual care visits, telehealth, app-based tools — appealing for younger, tech-friendly consumers.

- Transparent plan choices, often lower overhead and possibly lower premium or simpler plan structure in some states.

- Good option in states/markets where Oscar participates and has competitive pricing.

Potential drawbacks:

- Provider network may be narrower compared to the largest national carriers; if you have preferred specialists/hospitals you’ll need to check carefully.

- Because of smaller size and state-by-state variation, plan availability, benefits, and pricing can vary significantly — what works in one region may not in another.

- For consumers needing highly specialized care or many out-of-network options, the smaller carrier may be less flexible.

Best for: Younger individuals/families comfortable with digital and virtual-care focus, who live in a region where Oscar operates competitively, and who value simplicity and tech over maximum provider choice.

How to Choose Among These (and What to Watch)

✅ Match your usage profile:

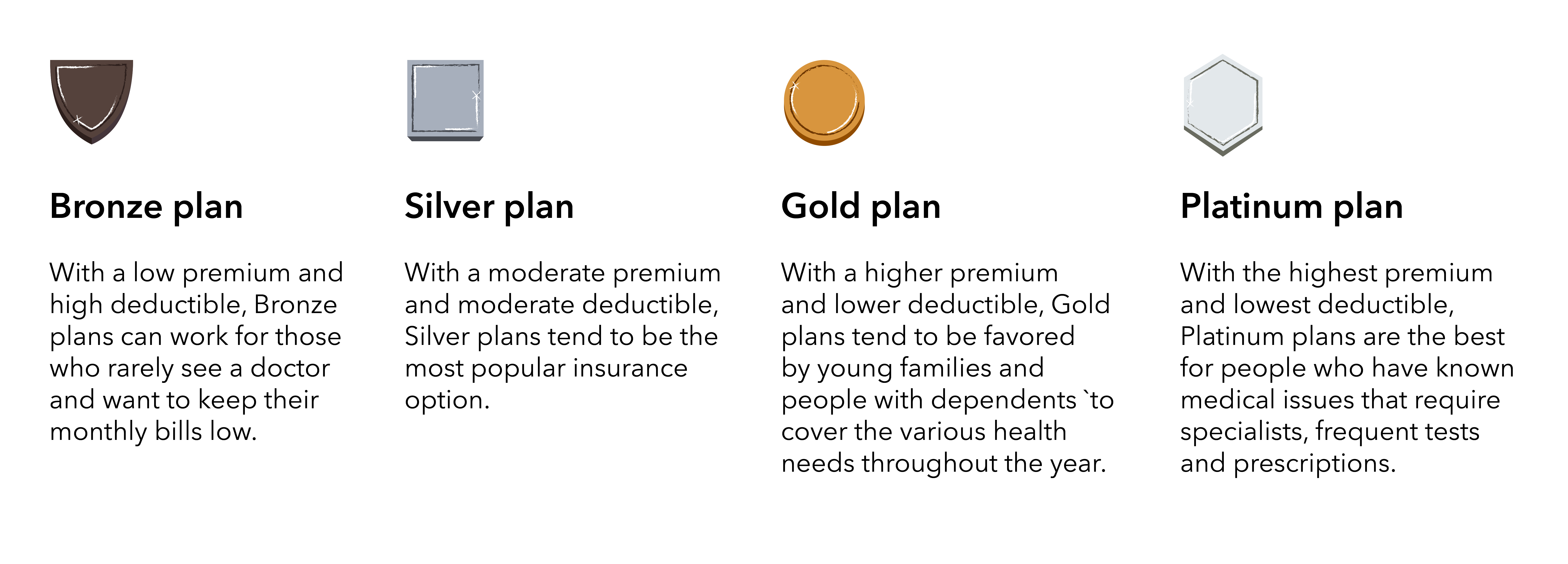

- If you rarely go to doctors and want a low-cost premium, perhaps choose a plan with higher deductible and limited extras.

- If you use specialists, have chronic conditions, or prefer specific hospitals/doctors, prioritize broad network and provider access.

- If you travel frequently or live / work in multiple states, choose a plan with multi-state access or a national network.

✅ Network & provider check:

- Always verify that your primary doctor, specialist, hospital are in-network before signing.

- Evaluate “out-of-network” rules and how they affect your anticipated care.

✅ Understand cost structure:

- Look at monthly premium, deductible, out-of-pocket maximum, copays/coinsurance, and what counts toward those maxima.

- A low premium plan may mean high deductible or limited network — which might cost more if you need more care.

✅ Extras & value-adds:

- Some plans include adult dental/vision, wellness programs, generic-drug discounts, telehealth benefits.

- These extras may tip the balance for certain consumers, but they should not replace essential coverage.

- Example: Aetna may include adult dental/vision in some states; Oscar emphasizes telehealth.

✅ State and market matters:

- Plan availability and benefits differ by state and insurer affiliate. What one carrier offers in California may differ from what they offer in Florida or Texas.

- Some insurers may exit or reduce offerings in certain regions — e.g., major carriers scaling back Medicare Advantage/Part D in some markets for 2026. Kiplinger

- Always check local marketplace, subsidy eligibility (if under ACA), and whether employer or individual market applies.

✅ Future-proofing & continuity:

- If you pick a plan now, consider whether the insurer is stable in your region, has a good complaint-index record, and whether network/provider disruptions are likely.

- Check whether your provider network or plan structure changed historically — big changes mean you may face transitions.

Final Thoughts

Each of these five carriers offers strong options, but your “best choice” will depend heavily on where you live, which doctors you want to use, how much care you expect to need, and what you value most (cost-savings vs flexibility vs tech tools vs wellness extras).

- If you live in a Kaiser region and want coordinated care with minimal hassle → go Kaiser Permanente.

- If you want the broadest access and flexibility → consider Blue Cross Blue Shield.

- If you want a major national carrier with big digital offerings → UnitedHealthcare.

- If you want value-adds like dental/vision, strong pharmacy tie-ins and live in a strong state market → Aetna (CVS Health).

- If you are younger, comfortable with digital first and want a fresh, tech-centric experience → Oscar Health.

Before enrolling: verify plan details in your ZIP code/state, check provider network, read the fine print of benefits, and compare cost structures side-by-side. Choosing wisely now can mean better access, lower stress, and fewer surprises down the road.

Leave a Reply